open ended investment company vs unit trust

The terms OEIC and ICVC are used interchangeably with different investment managers favouring one over the other. They are both pooled investment funds run by a professional.

Do Closed End Funds Perform Better Than Open Ended Funds Quora

Since 2001 the Shares Awards have recognised the high quality of service and products from companies in the world of retail investment as voted for by Shares readers.

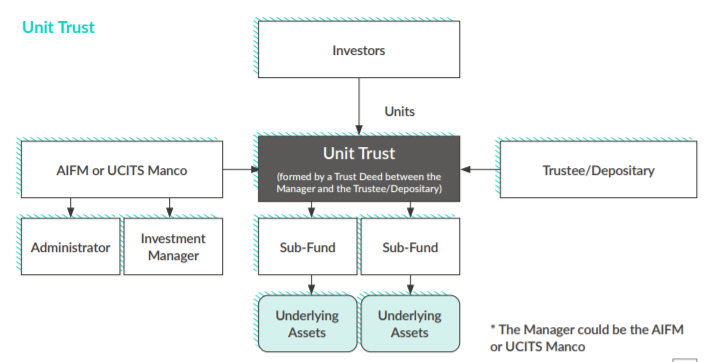

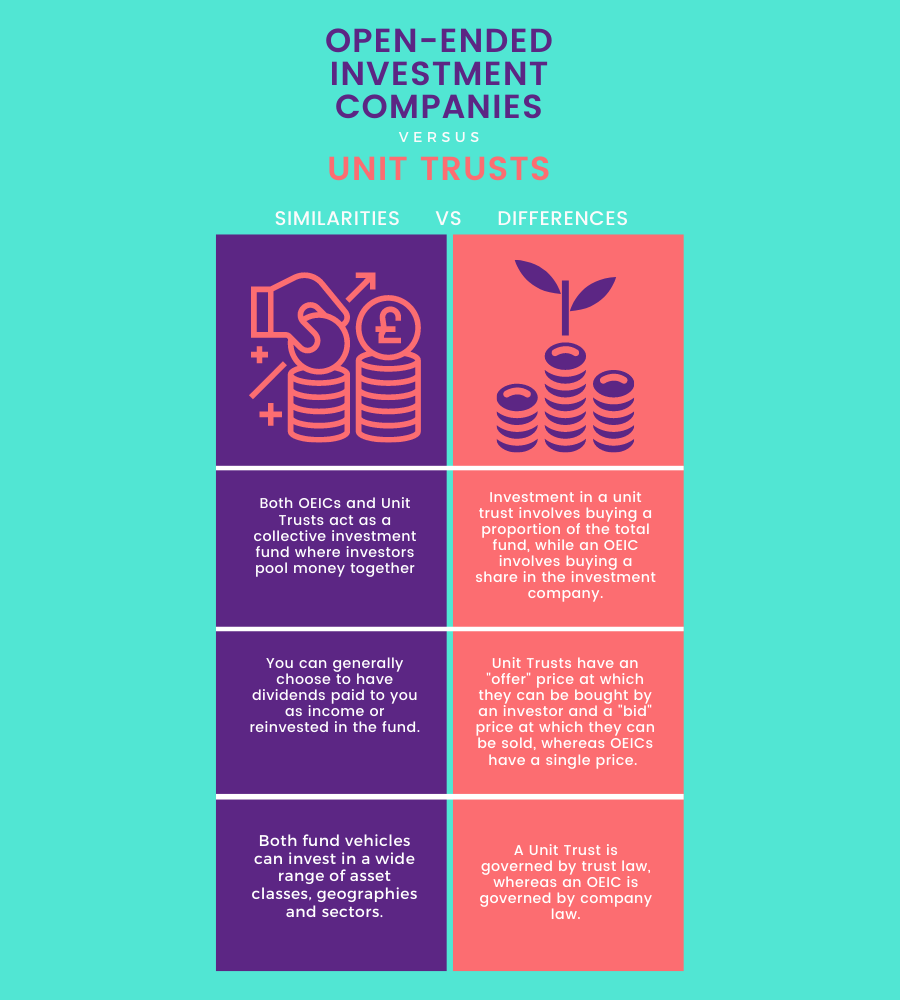

. Furthermore UITs do not reinvest dividends. Like OEICs unit trusts consist of a manager who buys stocks and bonds for holders of a fund in an open-ended format. The major difference is in pricing as unit trusts quote a bid price to redeem and an offer price when you buy with a spread that aims to ensure new or redeeming investors dont dilute the.

Investment in a unit trust also involves. Open-ended funds used to have a bid and offer price too but most have now converted to a new kind of legal structure called an open-ended investment company OEIC. UITs are used by ETFs to track broad asset classes and unlike open-end funds their investment ability is limited.

VCC is a collective investment vehicle established as a company. Essentially unit trusts come with added cost weight that should be taken into account when deciding between an OEIC vs unit trust. VCC is designed to allow individual and institutional investors to invest in a well-diversified and professionally.

Unit trusts are known as open-ended funds on the basis that they grow or contract in line with demand issuing or cancelling units in the fund. They are open-ended and the price of each unit unit trust or share OEIC depends on the net asset value NAV of the funds investment. Technically this means investors in a unit trust are not owners of the underlying assets unlike investors in an OEIC.

Among the two most commonly debated are closed and open ended funds - that is investment trusts and unit trusts. In the UK OEICs are the preferred legal form of new open-ended. They are bought and sold directly from the issuing.

In many ways unit trusts and OEICs are the same. The two mainly differ in the way they are priced. Unit Trusts and Open-Ended Investment Companies OEICs Unit trusts and Open-Ended Investment Companies OEICs are professionally managed collective investment funds.

Unit Trusts Vs Oeics What S The Difference Eqi

Terry Smith Why Open Ended Em Funds Will Only End In Disaster Trustnet

Successfully Launching An Open End Fund Sadis Goldberg Llp

:max_bytes(150000):strip_icc()/mutual_funds_paper-5bfc2f4b46e0fb00260bd35d.jpg)

Closed End Vs Open End Investments What S The Difference

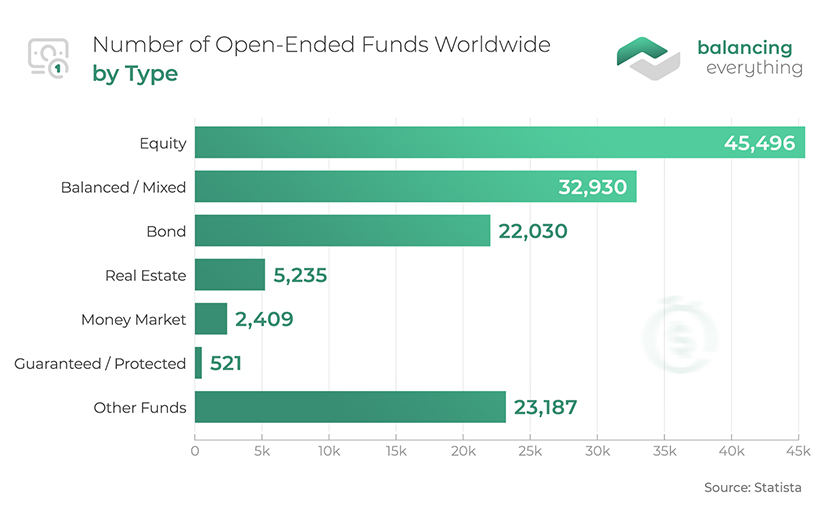

34 Mutual Funds Statistics Facts For 2022 Balancingeverything

Pdf The Performance Comparison Of The Open Ended Fund And Close Ended Mutual Fund In Pakistan

Open End Funds Vs Closed End Funds Smartasset

Open Ended Fund Definition Example Pros And Cons

A Guide To Investing In Closed End Funds Cefs

Mutual Fund Closed End Funds Vs Open Ended Funds Estate Market Fund Insurance Loan

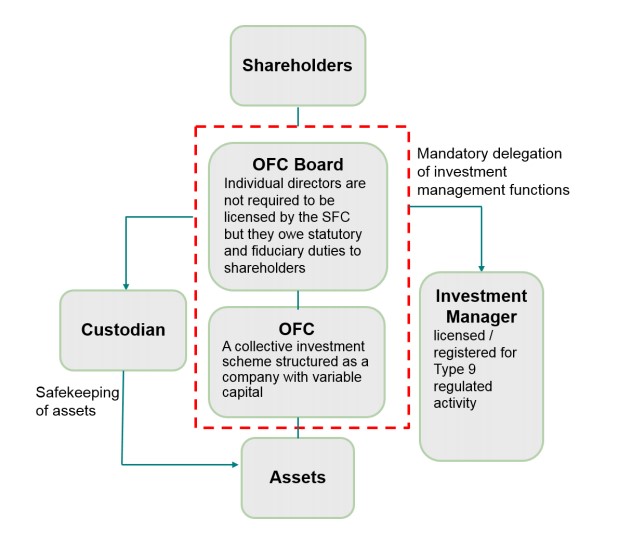

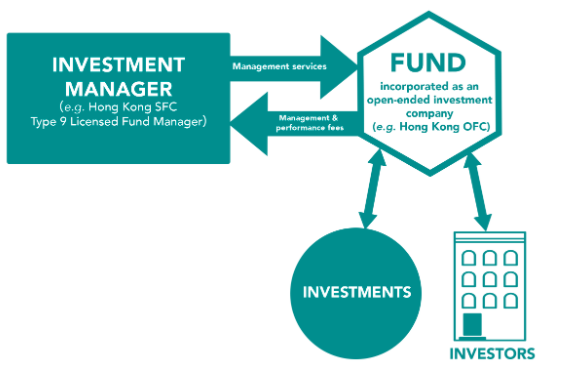

Assessing Asia Pacific S New Corporate Fund Structures Pt 1 Sponsored Profile Asianinvestor

Open End Vs Closed End Mutual Funds Youtube

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

Hong Kong S New Open Ended Fund Company Regime The Sovereign Group

Fund Structures Unit Trusts Lexology

How To Start A Hedge Fund In Hong Kong A Legal Guide Lexology

Unit Trusts Vs Investment Trusts The Compensation Experts

What Is The Difference Between A Mutual Fund And A Unit Investment Trust Fund Helpdesk Page